Advance United. Exit stronger.

Advance United’s business is powered by an engine comprised of three unique integrated layers that complement each other: Au Marketplace, an automated pipeline, and our property portfolio.

Au Marketplace.

Au Marketplace is an open source, Ai powered, primary data online platform connecting property owners of precious metals, base metals, and rare earth deposits with investors, developers, and producers.

Au Pipeline.

Au Marketplace makes prospecting effortless with automated filtering of properties that meet our portfolio’s strict criteria from a growing, global supply.

Au Portfolio.

The Company’s goal is to create a large and comprehensive portfolio of past producing and highly promising gold exploration properties in North America and land bank them. The value of each property that Au acquires is reengineered and evolved into peak value using the latest technology, instruments such as the NI 43-101 reports, and hands-on expertise until it’s either sold or partnered for exploitation through mid-tier and major mining companies. Au has no intention of mining itself.

Industry problems are opportunities. We’ve identified two big ones.

Au Marketplace.

There are many dormant, past producing properties bearing precious metals, base metals and rare earth deposits. Property owners seek a solution to the problem of having a property with an out-of-date or unestablished value and not having the means to move it forward. Without help, their hopes and dreams are dead in the ground. These are unloved projects that have need of analysis, value creation, financing, marketing exposure, and exploitation.

Au Marketplace provides these owners with a means to increase their property’s value through the application of technology and then provides the marketing muscle to connect owners with buyers directly. Alternatively, it connects owners to partnerships with mid-tier and major mining companies for next-phase development and production. In short, similar to Airbnb and Uber, Au Marketplace presents a platform economy putting property owners together with buyers.

Au Portfolio.

Most mid-tier and large gold mining companies are in the business of development and production, less so prospecting and property value creation. We’ve identified this gap as an opportunity. To this end we’ve acquired and continuing to acquire a large portfolio of undervalued, past producing gold bearing properties that meet our strict criteria and then increasing their value through the application of modern technology such as Ai, instruments such as NI 43-101 reports, field work, and analysis.

The opportunity is in land banking a growing portfolio of gold bearing properties without the cost and risk of mining. Each property is continuously evolved into peak value until it is sold or partnered for exploitation through mid-tier and major mining companies.

Au Portfolio. Evaluating criteria and value creation method

We identify gold properties where we believe there is underdeveloped and undervalued potential. Properties with significant historical work and previous drill programs which were uneconomic at the time but have proven economic value at today’s price of gold. We fund the development of re-working old data to create new NI 43-101’s, thereby documenting their quantifiable resources and reserves using current standards, thus increasing their value. The cost of re-working old data with modern technology is significantly more cost effective and allows us to deliver the highest returns to our shareholders, in the shortest possible time frame.

We adhere to a highly disciplined approach, and a strict set of physical property criteria and historic work protocols in our selection process. We then utilize modern technology, software and hardware to identify and evaluate properties that we can acquire for a low-cost to develop, exploiting newly realized potential and proven value. Leveraging our gold exploration experience and knowledge, by using modern exploration techniques, and by tapping into our industry network, we arbitrage the value of previous work programs against exploration potential with pre-development dollars to unlock the value of these properties.

We intend to develop a portfolio of properties with similar attributes – North American based properties, formation type, historic gold resources and/or production. The Company’s operations are in the most stable gold mining jurisdiction in the world, North America.

This provides us the five following advantages:

Large properties

Potential for extending resources at depth and/or along strike

Stable supporting infrastructure

Ready access to historic technical information work product

Favourable and prospective geologic environments

The deadly Lassonde Curve and the Au bridge.

We intend to grow our portfolio in regions we know to have significant gold-controlling structures and prospective geology, where historical production has been high. These are highly prolific areas, based on recognized world-class projects with high-grade gold discoveries. We will bring the properties to a stage where they are attractive to potential partners. In this way we avoid the ‘Orphan Period’ valley illustrated in the Lassonde Curve.

Advance United provides an optimum combination of protocols to recognize maximum stakeholder ROI though:

- A disciplined, strategic, and exacting approach to prequalify M&A targets

- Modern technology to advance historical findings

- Underwriting NI 43-101 economic resource and reserve development

- Strategic alliances with upstream partners to cross the bridge and mitigate the potential for the project being orphaned

The Canadian gold market.

Canada is the 5th largest gold producer in the world. Gold is Canada’s most valuable mined mineral, with a production value of $9.6 billion and gold exports of over $17.3 billion.

Ontario and Quebec together account for more than 75% of mined gold production in Canada. Ontario is the largest gold-producing region in Canada with a total of 20 gold mines, out of a total of 31 metal mines.

Canadian mines produced an estimated 183 tonnes of gold in 2019, which represents an 88% increase over production in 2009.

Canada is the 5th largest gold producer in the world. Gold is Canada’s most valuable mined mineral, with a production value of $9.6 billion and gold exports of over $17.3 billion.

Canadian Gold Production

The Global gold market.

In 2021, the US was estimated to have some 3,000 metric tons of gold reserves in mines.

In 2010, 2560 metric tons of gold was produced worldwide. Gold production increased to a peak of 3,300 metric tons in 2018 and 2019. In 2021, global gold production was 3,000 metric tons.

In 2008, gold mine production worldwide totaled 2,280 metric tons and increased to more than three thousand metric tons in each year since 2015. US production value of gold increased from 3.67 billion US dollars in 2005 to a high of 12.6 billion US dollars in 2012, and since has stabilized at 9.6 billion US dollars in 2017.

There are at least 54,000 tonnes of underground gold. Of that, the USGS gold report states that around 18,000 tonnes remain undiscovered in the US. (Source: World Gold Council, US Geological Survey)

Gold WGC data reports that exploration is extremely popular in three countries – the US, Canada, and Australia – together account for 40% of all global spending.

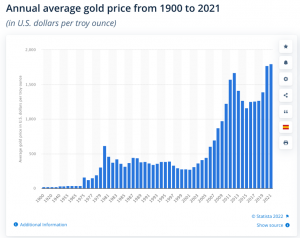

In 2020, gold had a 24.6% investment return rate.

Gold is the 3rd most popular reserve asset in the world, right after the European Euro and US dollar.

Source (unless otherwise indicated): https://www.statista.com/statistics/248997/reported-us-gold-consumption-since-2007/

Case study with a 381% ROI

Portfolio and 2021 pipeline.

Added to our 3 Canadian properties is Jumping Josephine, as well as newly acquired U.S. properties Landrum and Rattlesnake, all adding additional historic gold resources to the portfolio.

An executive team with over 100 years of experience.

The leadership team has significant industry and recognizable experience working with notable major mining companies including Newmont, VHP, and Agnico Eagle.

Added to this are industry experts in digital platform technology including open source and Ai.

With over one hundred years cumulative experience, our team has held positions as executives, directors, and advisors of publicly traded companies and are well versed in capital markets, investment banking, North American and international mining projects, and financial and reporting requirements.

Management has a successful track record of bringing projects from start-up through to financing, and from exploration to production, and buy-outs from majors.

So, why invest in Advance United?

- Au Portfolio. A growing land bank of gold-bearing properties with historic resources and potential to expand.

- A growing property pipeline.

- Dual listing on CSE: AUHI and Borse Frankfurt: 910

- Experienced management with successful track record

- Ability to raise additional capital through, flow through, trade, and institutional road shows.

- Au Marketplace. An industry first online platform connecting owners of precious metals, base metals, and rare earth deposits with investors, developers, and producers.

- Cash in the bank.

- No debt or liabilities.

- 43,981,406 shares issued.

How to invest in Advance United.

Au is listed on CSE: AUHI, and Frankfurt: 9I0. The company’s stock is available for purchase online, through a registered stockbroker. Most online brokerage firms also allow you to purchase stock.

For more information contact us: investors@advanceunited.ca