Creating a large portfolio of past producing and promising gold exploration properties.

Advance United’s principal property is the Doyle Property which is in the exploration stage. The Doyle Property consists of 109 mining claim cells and covers an area of approximately 3,265 ha located approximately 92 km southwest of Wawa, Ontario and 86 km north of Sault Ste. Marie, Ontario. It is subject to the JD Exploration Royalty. In addition, Au has two other exploration projects: the Buck Lake Property and the Paint Lake Road Joint Venture.

Doyle Property

We have continued to develop our Doyle project and in autumn 2019 we completed a ground geophysical test program to get a better understanding of the potential of the property. The results were interpreted using new computer algorithms that identified several high interest anomalies. In March 2020, we expanded with an airborne geophysics survey. In October 2020, we purchased a collection of reports, maps, and other documents detailing past work including geologic mapping, trenching, and IP geophysics from the previous owner. We are currently examining these documents with our 2020 work programs to create a budget for our 2022 work program.

Paint Lake Road Project

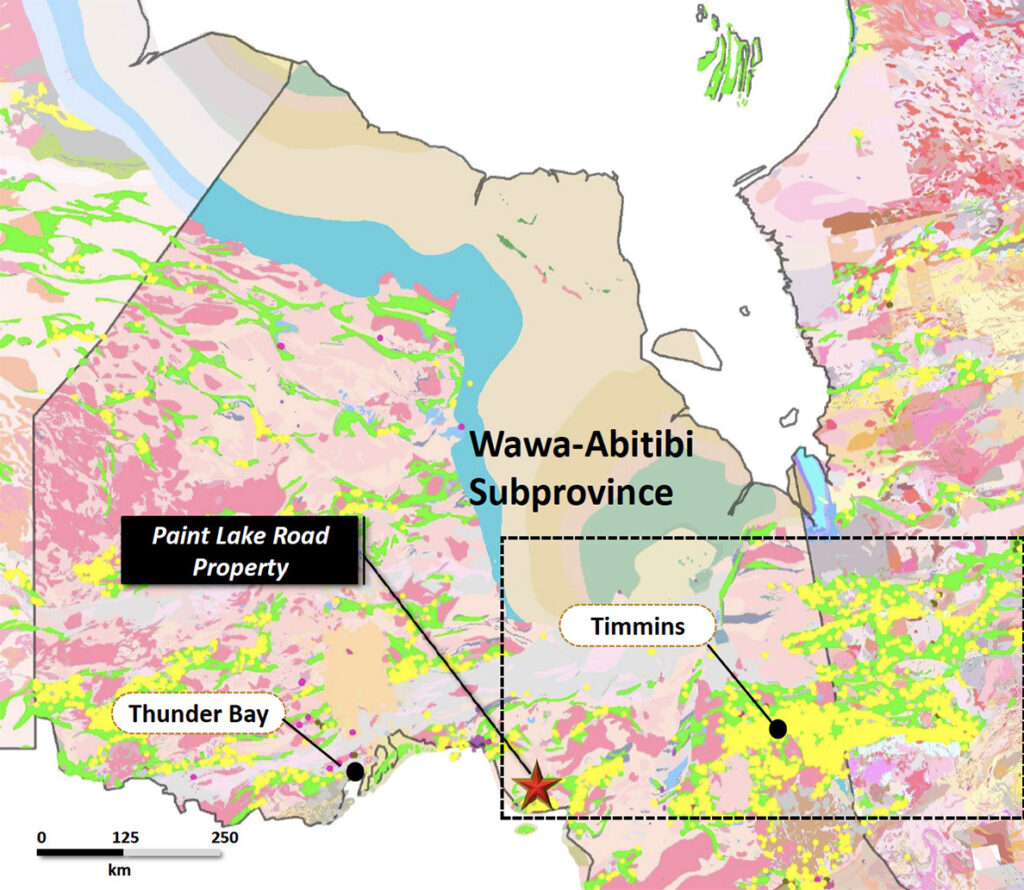

We formed a Joint Venture with Frontline Gold where our technical staff have identified a number of high potential gold targets. In March 2020, Advance United acquired a block of claims approximately 2 kilometers from Wesdome’s Mishi Pit and adjacent to Argo Gold’s Abbie Lake property which hosts gold showings along a major structure that extends onto Advance United’s property. Subsequent to acquiring the property Au was approached by Frontline Gold (whose CEO is a Director of the company) to form a Joint Venture with a group of claims Frontline Gold had recently optioned to the south of our property. It was agreed that each party would contribute their claims into a combined property, now called the Paint Lake Road Joint Venture, with each party owning a 50% interest. Advance United is the operator of the JV.

Buck Lake Property

No work was undertaken on the Buck Lake property, but under the ‘Exclusion of Time’ program initiated by the government due to the COVID–19 crises, we filed an extension keeping the property in good standing through 2021. The budget for 2022 is currently being negotiated.

Pipeline and 2022 Projects

Using our Wawa property as a process example with a 381% ROI (see case study) we have 3 current projects that are late-stage potential 3rd party acquisition.

Over the last six months, we have reviewed over twenty-five new projects, qualifying six, and actively proceeding with due diligence on two.

Future acquisitions and projects are based on a strict set of criteria. We’re developing the Au technology, an automation of our protocol requirements for property evaluation